A Nation Growing Older: The Unfolding Reality

Margaret never expected to be back in the workforce at 67. After decades of working as a nurse, she retired with what she thought was a solid plan. But as the cost of living soared and healthcare expenses climbed, she found herself applying for part-time jobs just to make ends meet.

She’s not alone. A United Nations report projects that by 2050, the global population aged 60 and above will double. This demographic shift is set to reshape policies, industries, and financial stability for millions.

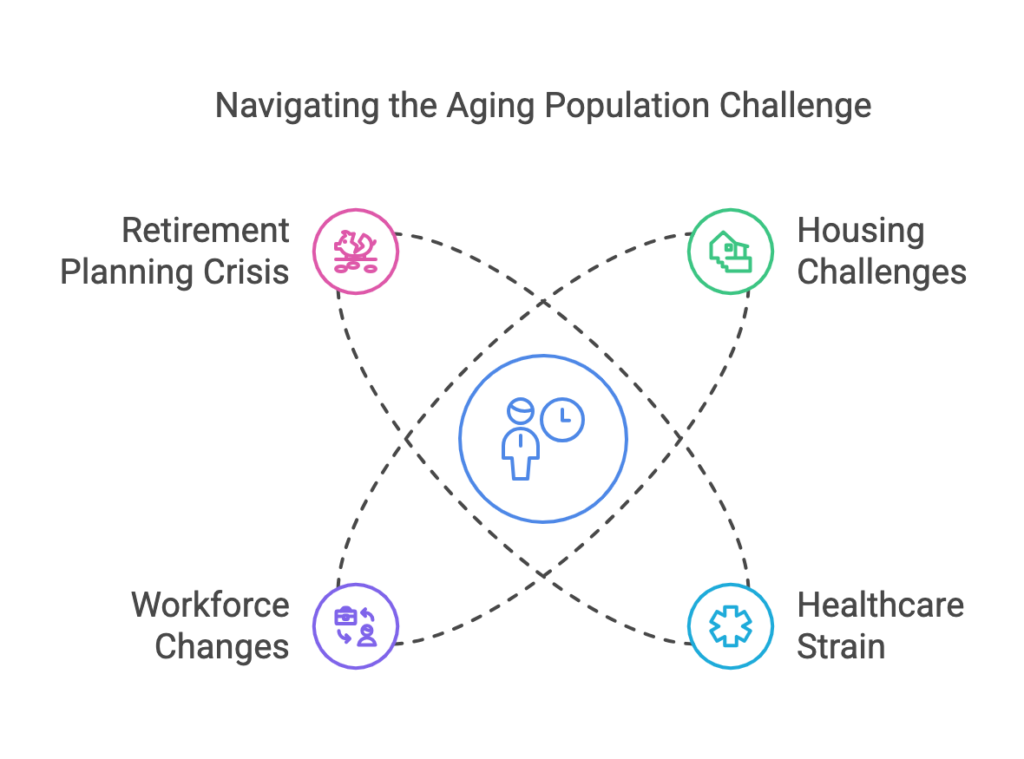

From housing shortages to shifts in healthcare and employment trends, the aging population is rewriting the future in ways few saw coming. What does this mean for you, your family, and the world as we know it?

The Rising Tide of Aging Populations

The aging population isn’t a future issue—it’s happening now. Countries across the globe are seeing a rapid increase in older adults, and the impact is already being felt:

- Housing Challenges: More seniors need accessible, affordable housing, but supply isn’t keeping up.

- Healthcare Strain: Longer lifespans mean greater demand for medical care and long-term support services.

- Workforce Changes: Many retirees are re-entering the workforce, changing job market dynamics.

- Retirement Planning Crisis: Traditional savings strategies may no longer be enough to sustain a longer life expectancy.

For Margaret, the reality set in fast. Retirement wasn’t the peaceful, worry-free time she had imagined. Instead, she found herself navigating a complex web of financial and healthcare decisions she hadn’t anticipated.

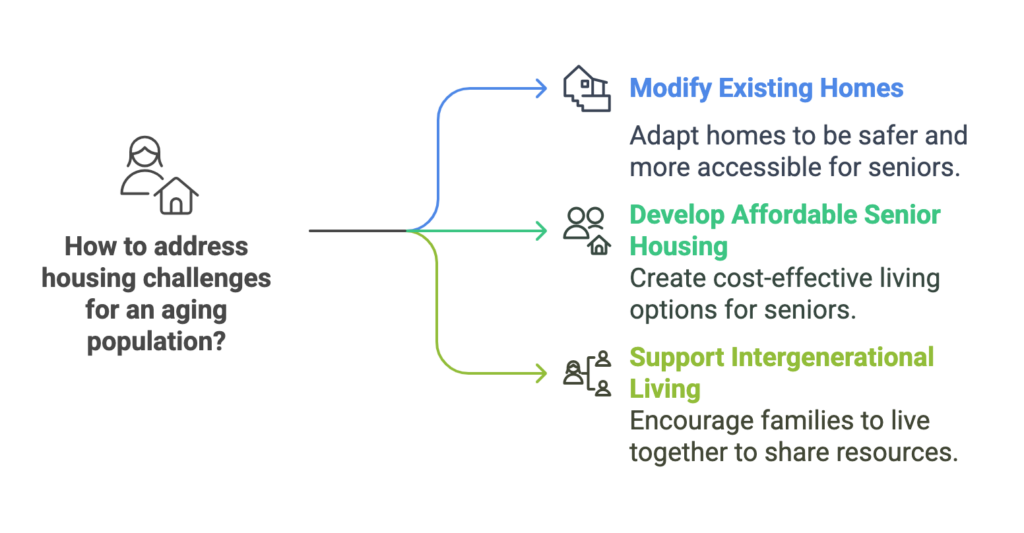

The Housing Dilemma: Where Will Seniors Live?

One of the biggest challenges of an aging population is housing. Many seniors want to stay in their homes, but:

✅ Homes often aren’t designed for aging—stairs, narrow hallways, and inaccessible bathrooms create hazards.

✅ Assisted living and senior housing are expensive, leaving many without affordable options.

✅ Younger generations are struggling to buy homes, increasing intergenerational housing issues.

The growing demand for age-friendly housing is prompting a shift in urban planning and policy. But for many like Margaret, these changes are too slow to make a difference today.

Healthcare Systems Under Pressure

As more people age, healthcare needs rise.

✅ More doctors and specialists are needed to treat chronic illnesses.

✅ The cost of long-term care is skyrocketing, creating financial strain on families.

✅ Caregiver shortages mean family members are taking on unpaid roles, leading to burnout.

Margaret’s biggest concern? Finding quality healthcare without draining her savings. With prescription costs rising and Medicare offering limited coverage for long-term care, she—like many others—is caught in a tough situation.

The Workforce Transformation: Seniors Returning to Work

Retirement at 65 is no longer a guarantee.

✅ Inflation and market volatility are pushing retirees back into the workforce.

✅ Employers are adjusting workplaces to accommodate older employees.

✅ Seniors are starting businesses and freelancing at record rates.

Margaret’s part-time job wasn’t part of her plan, but it became her lifeline. She’s not alone—millions of older adults are adapting to a changing economic landscape, proving that retirement is evolving.

Rethinking Retirement Planning

With longer life expectancy, traditional retirement savings methods need a reboot:

✅ Social Security alone isn’t enough—additional income sources are critical.

✅ New savings strategies, such as longevity annuities, are gaining popularity.

✅ More retirees are downsizing or moving abroad to cut costs.

For those nearing retirement, adapting early is key. A financial plan that worked 20 years ago may no longer be effective in today’s economy.

What This Means for the Future

The aging population is changing everything—from housing policies to workforce structures and retirement planning. It’s time to prepare for a world where aging is the norm, not the exception.

Margaret’s story isn’t unique. It’s the reality of millions who are navigating an uncertain future. The good news? With the right planning and adaptability, aging doesn’t have to be a crisis—it can be an opportunity.